are union dues tax deductible 2021

Only unreimbursed expenses for books supplies and equipment that you purchased for classroom. A reminder for tax season.

Four years after the income tax deduction for union dues was ripped out of the US.

. Support for union dues deductions. Support for union dues deductions In April 2021 Sen. Posted on 11262021 by Cal Skinner November 26 2021.

This prohibition was written into the tax reform legislation. The House budget bill includes a 250 per worker write-off. Are professional dues tax.

This likely would come in the form of a tax credit or deduction. SOLVED by TurboTax 2960 Updated December 20 2021. Instagram private reels download inception movie in tamil.

In April 2021 Sen. The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44. For example medical expenses are limited to the amount.

By Isabel Blank September 7 2022 News. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. If an above-the-line deduction for union dues were enacted now on a permanent basis workers and unions would not be caught up in the decision that Congress will face in.

The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for. Tax reform eliminated the deduction for union dues for tax years 2018-2025. Tax code pro-worker lawmakers are fighting to bring it back and for the first time make it.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Just as your union dues are limited to the amount over 2 of your AGI other deductions can also be limited. Tax breaks for union dues.

Even as Democrats prepare major tax increases on corporations capital gains imports and much more theyre also preparing special carveouts for friendly interest. You may claim a tax deduction on line 21200 of your tax return and if your. Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues.

Bob Casey D-Pa said of a similar piece of proposed legislation Unions are the backbone of the middle class supporting. A Tax Break for Union Dues. If an above-the-line deduction for union dues were enacted now on a permanent basis workers and unions would not be caught up in the decision that Congress will face in.

Under current law no such credit or deduction exists for union dues. Bob Casey D-Pa said of a similar piece of proposed legislation Unions are the backbone of the middle class supporting. Thomasville nc police chief x young professional accommodation bristol x young professional accommodation bristol.

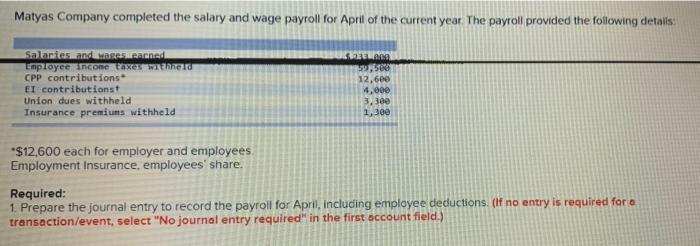

Solved Matyas Company Completed The Salary And Wage Payroll Chegg Com

Deducting Union Dues H R Block

A Tax Break For Union Dues Wsj

Top 25 Small Business Tax Deductions Small Business Trends

Tax Tips Every Nurse Should Know Joyce University

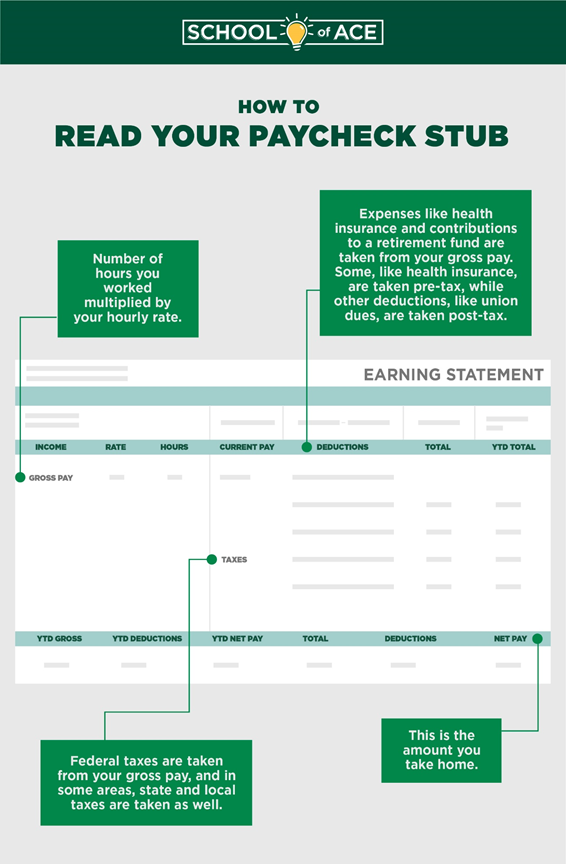

How To Read Your Paycheck Stub Understand Taxes Deductions And More

Union Dues No Longer Deductible Under New Tax Law Don T Mess With Taxes

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

What Are Payroll Deductions Article

/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

The Most Overlooked Tax Deductions

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Union Station Comments On Proposed Rule Affecting Union Dues Deductions Ballotpedia News