marin county property tax due dates 2021

Main Office McPherson Complex 503 SE 25th Avenue Ocala Florida 34471 352 368-8200. Tax Lien date affects the upcoming fiscal year January.

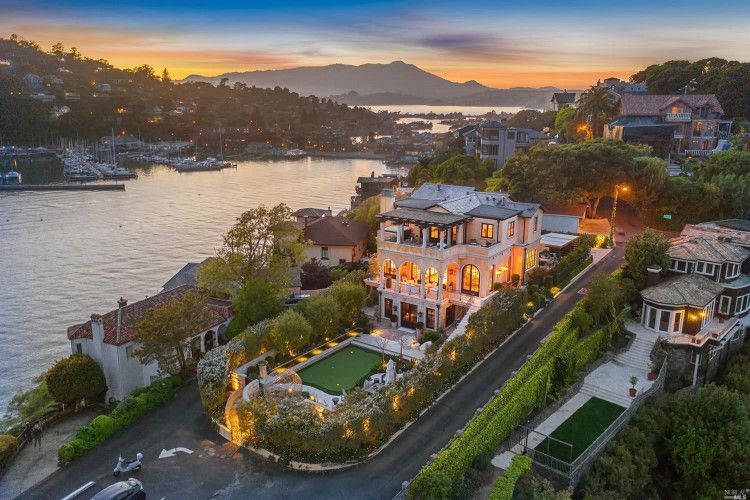

Marin County Real Estate Market Report February 2021 Trends Market News

A 10 penalty is added January 1.

. Please pay ontime to avoid penalties. Property taxes are due May 31 2022. What is the sales tax rate in Marin County.

The Treasurers Office is sending 95672 paper statements and 3428 e-statements to people who registered to receive tax bills online. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Taxpayers Can Expect to Receive Tax Statements by March 15 2022.

1st Installment due on the 3rd Monday in August. The Marin County sales tax rate is. April 30th First half of property taxes due If taxes are less than 50 full payment is due April 30th Personal property listing forms due.

Legislation enacted in 2019 HB407 allows school districts to have a mill levy question on the November election ballot thereby delaying mailing and due dates for 1st half of property taxes. 2nd Installment due on the 1st Monday in October. View our property tax resource guide Español Filipino 中文 to better understand how to navigate San Francisco property taxes.

The County Assessor sets the assessed value and the County Commissioners set the tax rates for the County. Property taxes must be paid or postmarked by the due dates below. Mailed in February Tax Payments.

July 1 Appeals to the County Board of Equalization must be filed by July 1 or within 60 days of notification. If the 15th falls on a weekend or holiday due date is the next business day. George Albright Marion County Tax Collector.

Property tax statements are mailed before October 25 every year. 173 of home value. On Monday April 11 2022.

One mill equals 100 per 100000 of property value. Tax amount varies by county. June 1 Three percent penalty assessed on delinquent taxes.

View 2021 Millage Rates. The first half taxes are delinquent after 5pm on 1112021. We normally expect to receive payments electronically 1-2 days before the April 11 deadline even if your mortgage company tells you or your statement shows it was sent earlier.

Treasurer-Tax Collector mails delinquent notices for any unpaid first installment current secured taxes. The minimum combined 2022 sales tax rate for Marin County California is. 2021 Property Tax Notices are available online.

The second installment is due by April 10 2022. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

4th Installment due on the 1st Monday in March. Clark County Treasurers Office Tax Collection. 3rd Installment due on the 1st Monday in January.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Tax bills are prepared and mailed out by August 1st of each year. The regular appeals filing period will begin on July 2 2021 in each county and will end either on September 15 or November 30 depending on whether the C ounty Assessor has elected to mail assessment notices by August 1 2021 to all taxpayers with property on the secured roll.

Pay your taxes in full by November 15 or make partial payments with further installments due in February and May. Pay online or by phone by 1159 pm. This is the total of state and county sales tax rates.

First installment of secured taxes payment deadline. Secured Property Tax bills are mailed in October. You may either pay the entire tax when the first installment is due or pay in two installments.

First Half- April 30 Second Half- October 31. However the property owner may elect to pay in installments if the taxes on a parcel exceed 10000. See your tax bill for details.

2021 property tax bills The property tax collection period normally runs from November 1 2021 through December 10 2021 and April 1 2022 through May 10 2022. Penalties apply if the installments are not paid by December 10 or April 10 respectively. Our services are available online by phone email or US mail.

Due to the heavy volume of mail and phone calls received near installment due dates processing payments may take up to 15 business days. Tax rates are set in June of each year. Property taxes are due on the third Monday in August.

The second half taxes are delinquent after 5pm on 522022. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days in advance of the event. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

You may also pay one full year payment by 132022 and you will not be charged interest on the first half taxes. Pay by mail postmarked by Monday April 11 2022. Important Property Tax Dates in 2021 JULY 23 2021 MOBILE HOME tax bills will be mailed September 8 2021 MOBILE HOME tax bills DUE Participating banks will accept property tax October 16 2021 paymentsPayments can be made online November 16 2021 First installment due November 17 2021.

Please include the 10 penalty to the first installment to avoid payments being returned. Learn how to read your secured property tax bill. Indiana is ranked 890th of the 3143 counties in the United States in order of the median amount of property taxes collected.

The median property tax in Marion County Indiana is 1408 per year for a home worth the median value of 122200. The California state sales tax rate is currently. The tax year runs from January 1st to December 31st.

Mariposa County 2021-2022 secured first installment taxes were due by December 10 2021. 2021-22 SECURED PROPERTY TAX BILLS The last timely payment date for the second installment is April 11 2022 IMPORTANT INFORMATION FOR MORTGAGE COMPANY PAYMENTS. The following table shows the filing deadline for each county.

Real Property Tax Real Estate 206-263-2890. If a tax bill is 100 or less the full amount is due on the 3rd Monday of August. Property tax statements include property tax levy rates amounts special assessments and certain fees.

KEY DATES 2021. We no longer accept partial payments. Real property and mobile home taxes are payable in 4 installments with due dates as follows.

Clark County Treasurer Alishia Topper today announced that property tax statements for 2021 are set to mail within the next week. More than 59000 property tax bills are mailed by the County Treasurers Office annually. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates.

First installment of secured taxes is due and payable. Marin County Tax Collector P. Box 4220 San Rafael CA 94913.

Send the correct installment payment stub 1st or 2nd when paying your bill. Duplicate bills are available on request. Marion County collects on average 115 of a propertys assessed fair market value as property tax.

The secured property tax rate for Fiscal Year 2021-22 is 118248499. Home News Community Directory Services Departments Accessibility Privacy Policy Disclaimer Employee Webmail 2022 Missoula County MT.

Restrictive Covenant Resources Marin County Free Library

Marin Property Tax Bills Top 1 Billion For First Time Marin Independent Journal

Will This Wealthy California Town Run Out Of Water Bloomberg

Marin County Measure C The Wildfire Prevention Authority Parcel Tax

Transfer Tax In Marin County California Who Pays What

Marin County Real Estate Market Report February 2021 Trends Market News

221 Marin County Apartments Change Hands In 188 Million Of Deals

Property Tax Bills On Their Way

![]()

Pandemic May Excuse Late Payment Of Due Marin Property Tax

6 Marin County Properties With Staggering 25m Price Tags Have Come On The Market In The Past Few Months

Marin County Real Estate Market Report September 2021 Latest News

Marin County Real Estate Market Report February 2021 Trends Market News

Marin County Mails Property Tax Bills Seeking 1 26b

Katie Rice Supervisorrice Twitter

Marinhealth Humansvc Marinhhs Twitter